kirkbi investment portfolio

Its largest disclosed acquisition occurred in 2015 when it acquired Armacell Enterprise for 11B. Their most recent acquisition was Merlin Entertainments on Jun 28 2019.

Epic Games Prepares For Metaverse Partners With Lego Sony

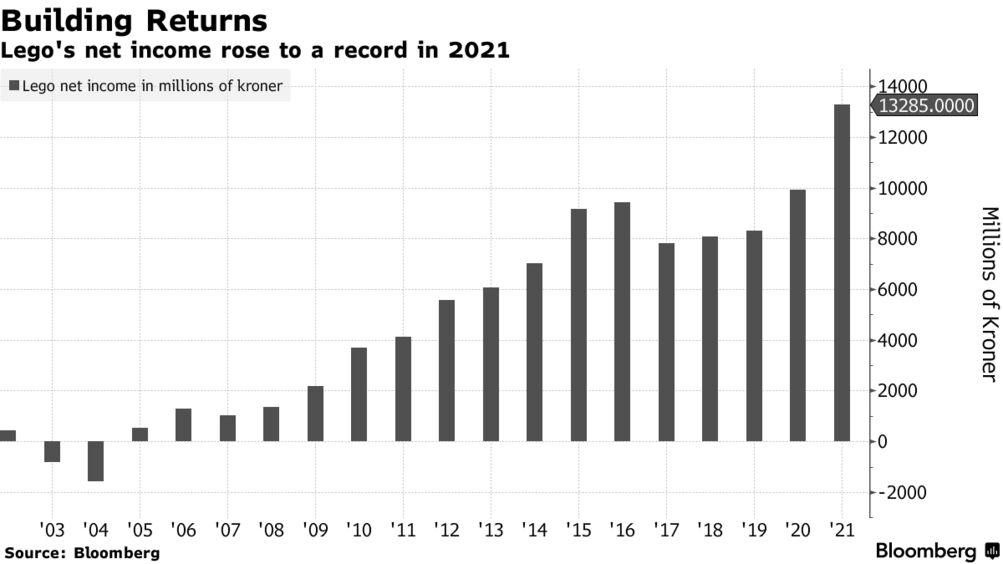

Net income at Kirkbi Invest AS quadrupled to 27 billion kroner 39 billion from 64 billion kroner in 2020 the Billund Denmark-based fund said in a statement on Tuesday.

. Apr 12 2022 1158 AM IST Sony Kirkbi invest 2 billion in Epic Games Both Sony and Kirkbi the investment company behind the Lego group have invested 1 billion each and the funds will be used. Kirkbi as and quantafuel as today announced that kirkbi the kirk kristiansen familys private holding and investment company invests nok 250 million into quantafuel a technology-based energy company converting plastic waste into low-carbon synthetic oil products and new high-value quality. Investment activities Family Support Our activities are focused on three fundamental tasks All tasks are contributing to enabling the Kirk Kristiansen family to succeed with the mission to inspire and develop the builders of tomorrow.

432 Matola B T. Finally the investment complements the KIRKBI Long-Term Equity portfolio and underpins our strategy to be a significant European investor Niclas Håkansson the Välinge CEO added. In the last 3 years KIRKBI AS has exited 1 company.

The 233 per cent gain at the investment portfolio far outpaced the companys own target of. Save this fund for later to form your own custom list of funds. Kirkbi which last week announced it will invest 1 billion in Epic Games -- the maker of the Fortnite game -- is the biggest shareholder in.

258 84 309 8310 258 84 325 9200 email. Epic Games has raised 2 billion in funding from Sony Group Corporation and Kirkbi the holding and investment company of the Lego group the Fortnite franchise creator has said. The KIRKBI Fundamentals serve as the compass in all business activities Søren Thorup Sørensen CEO.

KIRKBI AS has made 3 investments. Add fund to favorites. KIRKBIs portfolio of long-term equity investments is comprised by.

The companys investment activities include investments in renewable energy private equity long-term direct investments as well as real estate investments in Denmark Switzerland Germany and the UK. Portfolio analytics Team Investments News Media. The total size of the portfolio by the end of 2019 measured more than 300000 square metres of space.

Its portfolio anchored by a 75 per cent stake in toymaker Lego funds philanthropic endeavours renewable energy and adds to. Falck AS 286 ISS 166 Nilfisk 203 Välinge 484 LandisGyr 154 and Armacell 435. KIRKBI currently has a portfolio of 24 real estate capital investments located in Copenhagen Denmark London Great Britain Baar Olten Baden and Rapperswil Switzerland Munich and Hamburg Germany.

Kirkbi said the investment return was driven by its equity portfolio which includes stakes in office-service company ISS AS and Nilfisk Holding AS a maker of. The Company focuses on liquid investments and less liquid investments including long term direct equity investments. Evergreen cabin rentals adirondacks.

HOW WE ENGAGE AS OWNERS Through board representation KIRKBI seeks to influence the strategic direction and contribute to creating sustainable growth in portfolio companies. Kirkbi of Denmark has an appropriately Nordic model. End of 2017 KIRKBI Invest AS acquired 484 ownership of the Swedish flooring technology company Välinge.

KIRKBI is committed to a long-term and responsible investment strategy to ensure a sound financial foundation for the familys activities. NYSEBX completed the acquisition of 7042 stake in Merlin Entertainments plc from ValueAct Capital Master Fund LP a fund managed by ValueAct Capital Management LP. In total KIRKBI AS has invested in 3 different countries.

As a long-term strategic shareholder in Merlin Entertainments plc KIRKBIs interest remains in ensuring a sustainable future for the LEGO brand and its branded activities such that it delivers superior experiences for all visitors worldwide. Founded in 1995 KIRKBI is a private holding and investment company of the Kirk Kristiansen Family. Their most recent investment was on Apr 11 2022 when Epic Games raised 2B.

We are very excited about the new ownership cooperation which will help us continue the development and global roll-out of new technologies and ultimately. KIRKBI AS has had 1 exit which was Välinge Innovation Sweden AB. The long-term equity portfolio consists end of 2017 of ownership in ISS AS MV Holding GmbH Nilfisk Holding AS and Falck AS.

This summary is composed by our algorithm based on the analysis of the deals. Kirkbi which last week announced it will invest US1 billion in Epic Games - the maker of the Fortnite game - is the biggest shareholder in both companies. They acquired Merlin Entertainments for 59B.

The Firms most common investment types include secondary buyout 58 and buyout lbo mbo mbi 29. Kirkbi Invest AS Canada Pension Plan Investment Board and Blackstone Core Equity Partners fund managed by The Blackstone Group LP. Rua da Educação no.

Billund denmark and oslo norway 19 june 2020. KIRKBI AS has acquired 3 organizations. KIRKBI is the holding and investment company of the Kirk Kristiansen family.

KIRKBI AS is the Kirk Kristiansen familys private holding and investment company founded to build a sustainable future for the family ownership through generations. KIRKBIs investment portfolio amounts at year-end. The transaction is pending closing which is expected to happen in the first half of 2018.

Kirkbi Invest AS operates as an investment company. Furthermore KIRKBI is dedicated to support the family members as they prepare for future generations to continue the active and engaged ownership as well as supporting their private activities companies. DEFINITION OF INVESTMENT ACTIVITIES The KIRKBI Groups investment activities are divided into Core Capital and Thematic Capital investments.

Kirkbi To Acquire A Minority Stake In Valinge Group From Kkr 2018 01 10 Floor Trends Magazine

Kirk Kristiansen Family Investment Arm Kirkbi To Acquire Kkr S 49 8 Stake In Valinge Europawire Eu The European Union S Press Release Distribution Newswire Service

Lego Family Office Quadruples Profit In Record Result

Kirkbi Core Capital Investments

Kirkbi A S Investments Portfolio Company Exits

Kirkbi Core Capital Investments

Lego Billionaire Family Fund Kirkbi Invest Surges On Toymaker Portfolio Gains Bloomberg

Kirk Kristiansen Family Investment Arm Kirkbi To Acquire Kkr S 49 8 Stake In Valinge Europawire Eu The European Union S Press Release Distribution Newswire Service

Lego Billionaire Family Fund Kirkbi Invest Surges On Toymaker Portfolio Gains Bloomberg

Kirkbi Lego Owner Builds A Case For Diversification Brick By Brick Financial Times

Kirkbi Arsrapport 2020 By Rosendahls Online Issuu

Sony And Lego Family Invest 2 Billion In Fortnite Creator Epic Games

Kirkbi Blackstone And Cppib Agree Terms Of A Recommended Offer For Merlin Entertainments Plc

Kirkbi A S Investments Portfolio Company Exits

0 Response to "kirkbi investment portfolio"

Post a Comment